Small Business Owner: You Too Can Have a Risk Management Strategy

GA4 GTM Snippet

By Heather Curtis - Wednesday, March 5, 2014

Hi I’m Heather, one of the AssureStart teammates. I was brought over to bring up Workers’ Compensation insurance once our Business Owner’s insurance product is rolled out to a majority of states. I have been in the insurance industry for 25 years and I hold an Associate in Risk Management (ARM) and Certified Property and Casualty Underwriting (CPCU) designation. I have seen a bazillion business operations in my career - from making bagels to melting metal. But after joining a small business last April, I have a new understanding and deep appreciation for the tenacity, dedication and commitment it takes to be a small business owner!

I was asked to write a blog entry on loss prevention; a subject near and dear to my heart. Let’s get some definitions out of the way. A Loss is defined as an unknown or unexpected financial consequence as a result of accident or injury. Loss Prevention by definition lowers the likelihood that a particular circumstance will result in a loss. For example; dead bolting a door reduces the likelihood of a break-in at your establishment. Or, using platform ladders with guardrails (like the ones you see used at Home Depot) to access high shelving, could reduce the likelihood of someone falling off a ladder in a retail store.

Did you know that loss prevention is only one technique used in the risk management process? There are five additional risk control techniques that you can use to reduce or eliminate unknown and unexpected financial consequences known as a LOSS.

Are you thinking that this is too complicated? It doesn’t have to be. You are an expert at your small business operations; who knows more about your business than you right now? There are companies out there that can provide loss control service or risk management consulting if you feel your products, processes or location requires special expertise. These services are usually very specialized and come with a price tag.

But, you don’t have to wait and you shouldn’t wait - you can start today. You can set up your own risk management strategy to reduce the chance of surprises and plan for the unexpected. You probably have some sort of business plan – you can use that. Also try to recall any prior claims, losses, or near-mishaps your company has had and incorporate information from them into your plan. If you’ve had business insurance in the past and have filed claims, request a ‘loss run’ from your agent to get additional detail on your past claims.

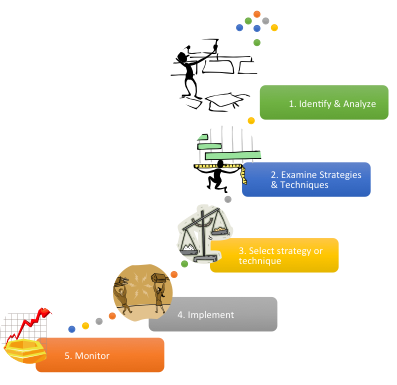

The Risk Management process involves five basic steps to help you identify your key risks and find the best solutions that fit your business, the first is:

Step 1. Identify risk, anything and everything that could possibly happen. No one can anticipate everything, but a good white boarding session around “what if” will go a long way in identifying what could possibly go wrong with regard to your property; what accidents could happen affecting employees, location, building and equipment, or other liabilities that could arise from vendors that you rely on. For example “What if my supplier goes out of business?” or “What if my old warehouse burns down?” You might determine through this exercise that there is a potential for a loss to such a magnitude that you discontinue a specific operation or stop a process. This could be an informative afternoon– use all your resources, employees, partners or even someone inside or outside your business network to participate. The more eyes and brainstorming – the better.

Step 2. Examine what alternatives or strategies you might employ if any of these things were to happen. Prioritize so you are working on big stuff first – the stuff that has greatest negative impact to your operation. “I am just not going to do that operation or process – it’s too risky” or “I will look for an alternative warehouse that has a fire suppression system and insure my personal property” or “I will find at least one or maybe two back up suppliers”. All of these solutions are a demonstration of Risk Control Techniques. Deciding not to do some process or operation because there is just too much risk potential, is a risk control technique called Avoidance. Using a warehouse that is better prepared for potential of fire (e.g. has a sprinkler system) is Loss Reduction. Insuring your personal property is a Risk Transfer technique. And finding a backup supplier would be considered Duplication. But you don’t need to get caught up in the Risk Control Technique terminology. Keep your focus on developing your Risk Management Strategy and we can get into terminology in later blogs.

Step 3. Now it is time to select the strategy or technique that best fits with your profit and operational goals and also GETS THE JOB DONE! There might be multiple solutions to a given problem. Decide what action or coverage is needed for each situation. You just have to weigh the options based on cost effectiveness and timeliness. Risk management is all about what the risk is to your operation versus the cost to your operation. You’re the business owner, you have made these types of decisions before. There are many resources out there in the Risk Management space if you feel you need more resource.

Step 4. This is where the rubber hits the road. Implement your solutions! You have made some decisions on your strategy and how you plan to handle a given situation that could arise and surprise. Implementation should start with documentation – even if it is a picture of your whiteboard! Taking pictures of your property is also good documentation to support your plan. If there is a strategy that involves your staff, they should be made aware of the process and trained. You may even need to do more elaboration of a strategy like “What should my employees do if we are robbed”. Get the plan documented, train your staff and by all means keep your work in a safe place that you can revisit, at the very least on an annual basis. Because your last step and the one that is critical to success is to……

Step 5. Monitor your outcomes! Does anything need to be tweaked? Once you implemented did you find out additional information that informed the process or potentially changed the solution? If you placed insurance coverage – is the amount of insurance still appropriate? If you had a previous loss history, have you implemented a strategy to reduce or eliminate the potential of that loss reoccurring? If you have practiced good risk control technique- you made a Duplicate of your Risk Management Plan and Separated the document with other important papers, so hopefully you can find the plan to update it!

My hope is that you found this helpful and informative. If you have, leave me a comment and I will accept another blog challenge from the AssureStart teammates. Remember your Risk Management plan does not have to be perfect out of the gate, just exercise the same tenacity, dedication and commitment that lead you to be a small business owner!